Embrace change: it’s the key to not just surviving mergers and acquisitions but thriving and showing true leadership. In this episode, Jennifer joins Tony Martignetti to discuss the power of people in Mergers & Acquisitions. Discover the unexpected journey of an accidental entrepreneur, who transforms the daunting topic of M&A into a relatable, engaging conversation. Jennifer shares the human side of mergers and acquisitions, explaining how embracing change becomes the key to not just surviving but thriving in times of transition. She also touches on change management, courageous writing, and more.

Podcast: Changing the Narrative on Mergers and Acquisitions (with Eloma)

“The payday is a lovely part. But don’t let that drive how you look for your partner, particularly if you want to leave a legacy worthwhile,” explains Jennifer Fondrevay. Mergers and acquisitions have a bad reputation, in part because statistics show that 70-90% of deals fail. However, it is important to still see a merger or acquisition as a viable growth strategy.

Listen to the full conversation with Kiley Peters.

Fox4 Jacksonville: How to Impress the Boss

How to impress the boss without looking like you’re sucking up

Everyone wants to create a good image at work, but your efforts can come across as disingenuous if you’re not careful. It can be difficult to promote yourself more without looking like a suck up.

Jennifer was the featured expert in this piece, noting that “Your goal is to exhibit what you are capable of, the contributions and value add that you bring.”

Contributor: How to Align Life Sciences Teams After a Merger | Lattice

Jennifer was quoted in this Lattice article on aligning Life Sciences Teams following a merger.

Innovation requires a culture of trust.

Life sciences companies are built on innovation — and research shows that innovation takes trust, collaboration, and the sharing of ideas. Unfortunately, trust is often one of the first casualties of an M&A.

“One of the great ironies of M&A activity is that trust, a key ingredient for business success, often quickly dissolves, as M&A activity is usually cloaked in secrecy,” Jennifer J. Fondrevay, the founder of Day One Ready, an M&A consultancy, explained in a 2018 article in Harvard Business Review.

“A workforce can feel blindsided when a deal is announced, eroding trust and transparency in three mutually reinforcing ways: “our” company versus “their” company; the executive team versus frontline employees; [and] who stays versus who goes.”

Middle Market Growth Contributor

High Prices Raise Stakes for Deal Success

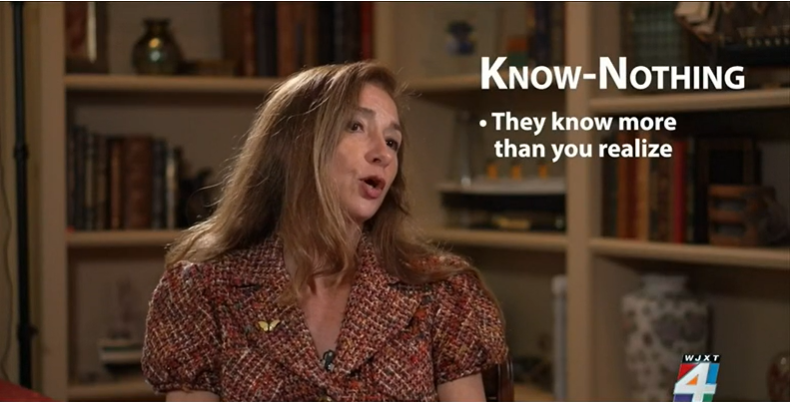

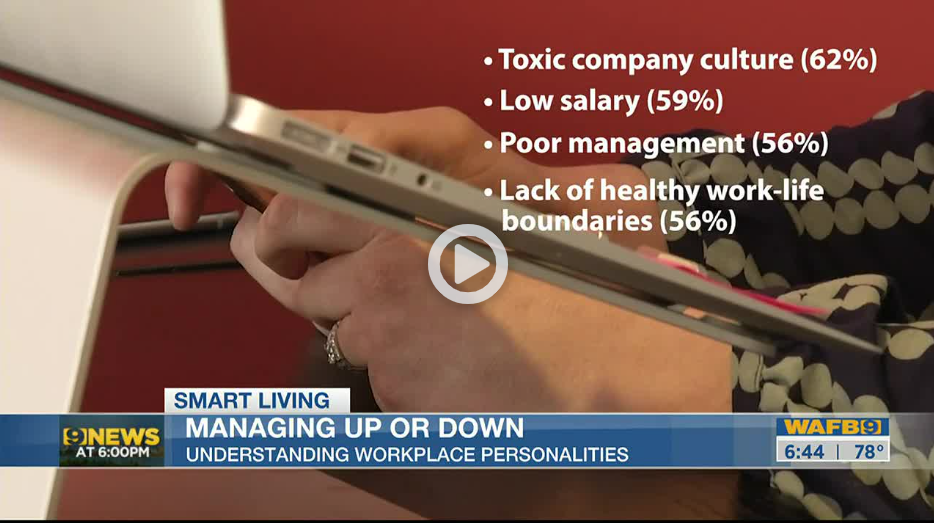

Familiar Personalities at Work: Recent News Sements

I recently had the pleasure to introduce the Characters to several news stations. Take a peek…

WFFF Fox44 Burlington, VT

KSAT12 ABC St. Louis

News4 JAX

WAFB 9 Baton Rogue

Fox 32 Chicago: Understanding Your Boss’ Style and Why It Matters

I spoke with Fox 32 Chicago to break down several less-than-effective leadership styles and how employees can best mesh inside the workplace.

PODCAST: WHY M&AS FAIL AND HOW TO FIX THIS

One of the primary reasons that a merger may fail is less about strategic, operational, or financial fit. Rather, it may be that the two companies’ embedded cultures cannot be easily aligned. Some issues may surface during the due diligence phase but identifying how the cultures are going to work together is paramount.

In this podcast with Andrea Petrone, Jennifer discusses:

- The mutual benefits in employing humility, respect, and understanding.

- Why there needs to be acceptance of the change occurring within the workforce.

- How to retain critical talent in the workplace.

- Why it is important to lead by example.

Read the full article about the interview here: Why M&As Fail and How to Fix This

5 Best Practices When Crafting your M&A Onboarding Experience

Post mergers & acquisitions (M&A) onboarding is NOT your typical onboarding journey. However, intentional planning and appreciation for your new employees’ mindset can play a critical role in setting your new employees up for success.

In an M&A scenario, employees have not been actively recruited to join your company. The excitement and eagerness to “be part of the team” are not typically there. In fact, if the newly acquired company will be changing its name to the acquiring company, these new employees may even think about revolting. This reality requires a different mindset and approach as you onboard your employees.

Read all 5 best practices in my guest article for Silk Road Technologies.

PODCAST: GEXP COLLABORATIVE WITH RYAN TANSOM

October 2018

M&A IS MESSY: THE IMPACT OF COMPANY CULTURE PRE AND POST SALE

WITH RYAN TANSOM

Jennifer talks with Ryan about her experiences with M&A and how she has met a need that many businesses don’t think about until after the fact. That need, of course, is keeping your employees and more importantly middle managers in the loop about their future with your company once it is sold.

You Will Learn About:

- Jennifer’s background in advertising and marketing.

- How she got into M&A.

- Who her book is for and why she launched Day One Ready.

- Why M&A is important to a business.

- Why incorrect valuation is the main reason businesses fail the first year after a merger.

- The culture clashes that happen after a sale.

- Painting a clear picture of a company’s future is critical.

- How Jennifer provides transparency to the M&A process.

- The types of leaders you need to include in this process.

- Emphasizing how the employee fits into the new system.

- The stats of failure for an M&A business during the first year.

- The steps to considering people first.

- The importance of respect.

- Jennifer’s parting advice.

Takeaways:

The fact is your company will change after a merger. You need to ask the right questions and include the right people in your company to create a uniform and clear representation of how the business will change for the employees just looking for marching orders. If you show respect to your employees it will go a long way.