Familiar Personalities at Work: Recent News Sements

I recently had the pleasure to introduce the Characters to several news stations. Take a peek…

WFFF Fox44 Burlington, VT

KSAT12 ABC St. Louis

News4 JAX

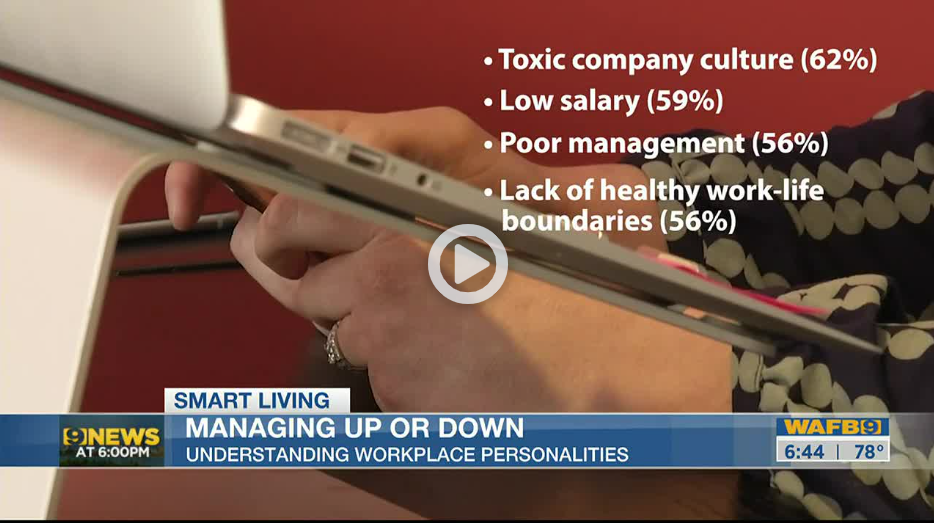

WAFB 9 Baton Rogue

Morning Blend: Women and Emotions at Work: Friend or Foe?

Showing your emotions at work used to be considered taboo; crying for women at work could be a career killer. Jennifer joins Molly Fay on The Morning Blend to talk about how this sentiment may be changing with the remote work/hybrid work environment we now find ourselves in and how the benefits of Emotional Intelligence EQ have been increasingly highlighted as valuable for managers to have.

PODCAST: Preparing for and Managing the People Challenges of M&A

Jennifer joins Dr. Vince Molinaro on Lead the Future to discuss how senior leaders can prepare for human capital challenges when undergoing a merger or acquisition, as well as how leaders themselves can navigate the changing and often ambiguous environment that arises post M&A.

Morning Blend: How is Your Boss Working Out?

Jennifer joined Molly Fay on The Morning Blend this month to talk about leadership personalities and how to have success at work no matter what style of boss you work for.

The Recent studies show that 75% of people who quit their jobs are actually quitting their boss. Understanding your boss’ style and how to work with it will set you up for success. It could mean the difference between thriving or diving at work.

TEDx Wilmette 2022: Create Opportunity in an Uncertain World

Uncertainty is not to be avoided and it’s not to be tolerated. According to Jennifer Fondrevay, we need to wholeheartedly embrace uncertainty and redirect our focus to the things we can control, our Talent, Effort, and Attitude. By embracing uncertainty, we will create our own opportunities and discover a fulfilling career and life.

This talk was given at a TEDx event using the TED conference format but independently organized by a local community. Learn more at https://www.ted.com/tedx

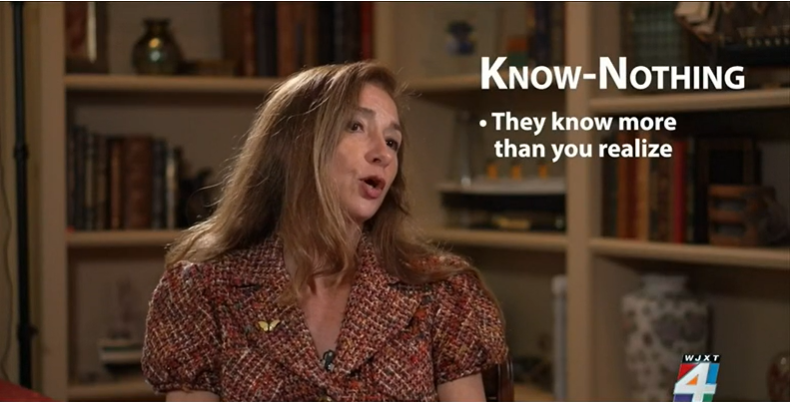

Fox 32 Chicago: Understanding Your Boss’ Style and Why It Matters

I spoke with Fox 32 Chicago to break down several less-than-effective leadership styles and how employees can best mesh inside the workplace.

PODCAST: GRACE under Pressure

Jennifer joined John Baldoni on LinkedIn Live for GRACE under Pressure, where he interviews thought leaders and doers whose ideas and actions are helping us come to a greater understanding of ourselves and the greater opportunities that await us.

You can listen to this podcast on YouTube, Spotify or Apple Podcasts.

Work Arts Interview

In this Work Arts interview, Brandon Curry and Jennifer J. Fondrevay discuss their individual experiences leading and advising organizations through mergers, acquisitions, and other significant transformations. Jennifer shares how calls for help have changed, including her perspective on lessons leaders have learned from leading through the pandemic that help us lead through transactions and transformations. Brandon and Jennifer also discuss how post-merger integration culture and team development work is different following nearly two years of hybrid and remote work.

Stars Rise & Fall at Work: How to Keep Shining

BY JENNIFER J. FONDREVAY AND AMY FRANKO

Read the article on FastCompany.com ![]()

Download the pdf version

As business strategies continue to shift and success metrics subsequently change, you can’t afford to stay stuck in your old way of doing things. The dramatically altered business and political landscape, along with the ubiquitous influence of digital in our lives, have decisively changed how a company succeeds. Companies in every industry around the world have had to adjust their metrics for success in some way. To be successful moving forward, you need to be smart on what the company now values and align your efforts with those objectives. If you don’t, you may end up as a former rock star.

We all probably know a rock star at work. Perhaps you identify as one. He or she can be high up the ladder or a high-potential leader on track to advance. They may be the top-performing sales leader or the product/marketing guru who has the ear of the CEO and the C-suite or is the proverbial “someone to watch” in the company. He or she could also be the industry specialist or innovator everyone goes to for new ideas. Strong and successful companies have rock stars across an organization, helping to drive the business forward. The trouble is, rock stars can stumble when the metrics for success suddenly change.

In my (Jennifer’s) consulting work with executives in mergers and acquisitions (M&A), I’ve seen too often the demise of the rock star. They become a former rock star because their attitude and behavior don’t adapt as the company’s growth strategies shift post-deal. What they believed to be important and valued at the company has been redefined and they struggle to redefine their role with it. In other words, they insist on playing hard rock, when everyone else has moved to disco. I’ve counseled many rock stars on how to stay on top of their game in times of change.

In Amy’s role as a rock-star sales performer early in her career and now a leading sales consultant, she’s equally seen top-performing sales professionals and leaders become former rock stars. They’re the sales performers who are reluctant to adapt their behavior because their formula for success got them to where they are. They’re used to getting the top sales awards every year based on that formula, so why would they change? Yet in today’s ever-changing business landscape, doing things as you have always done is no longer a recipe for success.

To stay valued at your company, and continue to be a top performer and “one to watch,” we suggest these five critical strategies:

SOLICIT OUTSIDE PERSPECTIVE

It can be tough to let go of old routines or ways of doing things, especially if they made you successful. But routines can become ruts. Don’t be afraid to ask for an outside perspective. Whether you solicit coworkers, a coach, or your own informal “board of advisors,” an outside perspective can help identify a rut you are in as well as your most valuable skills, sometimes better than you can. This outside perspective can help you fixate less on past achievements and focus more on where your skills can contribute to future success. Rock stars are comfortable acknowledging what they don’t know and seeking advice to adapt.

ASSESS YOUR SKILLS AGAINST THE EVOLVING NEEDS OF THE COMPANY

The skills that have brought you success will need assessing and perhaps some fine-tuning as you evaluate your company’s expanding needs. Perhaps your organization has introduced new revenue models to adapt and stay competitive. When Amy was a top sales performer at IBM, she recalls the shift IBM made from having an exclusive channel-sales model to a hybrid channel/direct model in the face of mounting competitive disruption. The sales professionals and leaders who succeeded were those who cultivated their strongest skills while embracing new ones as they monitored shifts in the marketplace. You can future-proof your career by understanding which skills are a match today and take the initiative to upgrade the skills you need.

STAY MARKET FORWARD

In times of disruption, it’s easy to shrink back and wait it out. That approach won’t serve you. You’ll miss opportunities, and you’ll be behind when the disruption normalizes. Beyond that, customers may think your business is struggling if you aren’t proactively adapting and staying connected. Greg Cole, chief marketing officer and managing director of BKD CPAs & Advisors, leads marketing and learning initiatives for nearly 3,000 staff members and 300 partners. He had this to share: “High performers remain focused on client relationships, communication, and engagement. The greatest shift is a renewed effort in meaningful outreach done via multiple channels. Making time for these connections is paying big dividends.”

How to stay market forward? For one, stay market-educated, and keep your relationships active. Connect with your best customers on how you are adapting, and stay on top of how their needs are evolving. Second, maintain a strong digital presence, both as an organization and as an individual, reflecting what you and your business are doing and how you may be adapting offerings. Three, be proactive with top prospects. Just as your top client’s needs have likely changed, so too have your prospects.

PRACTICE AGILITY

Disruption of any kind is an opportunity to practice agility. That is your ability to pivot strategically and decisively, maybe more than once. This is true not just for a company but also for your own approach. Becoming more agile can take various forms: practicing with new methods and tools for collaborating with the product team, or reexamining the allocation of your marketing budget to seek more effective opportunities, or even moving a client through your sales process in a completely virtual manner.

Jen E. Miller, senior vice president of producer development at global insurance firm Marsh & McLennan Agency LLC, works with nearly 1,000 producers and leaders on sales strategy and skill development. She observed: “Innovation and creativity will win the day here. Our leaders who are adapting, are willing to try new approaches, and who are assertive with new ideas are sustaining and growing business.”

Being more agile can expand your business as you serve current clients in new ways, while also gaining traction with prospects. One word of caution on this point: It’s always exciting to win a new client, but never before has it been more important to shore up current clients. Rock stars prioritize their top-tier customers by ensuring high levels of service that can lead to new opportunities.

BE A ROLE MODEL FOR THE ORGANIZATION

There’s no doubt that the sustained uncertainty we’ve all been facing takes a toll physically, mentally, and emotionally. It’s never prudent to make potentially life-altering decisions about your career, a client, or a team member while fatigued, overwhelmed, or riding on emotion. Rock stars know this; they keep their emotions in check and view themselves as a role model for the organization. They appreciate that others are watching, listening to, and emulating them. Nothing undermines change and its adoption more than behaviors by key individuals that are inconsistent with their words.

Role model behavior includes informally mentoring others through the changes, offering new ideas or approaches when prior efforts aren’t working, and consistently building relationships internally as the business adapts. As leaders navigating change on the frontline, rock stars need to be passionate drivers—people who question the traditional way of doing things, dig into complex problems, stick with them until they are solved, and have an appetite to innovate. Rock stars stay future-focused rather than fixating on past achievements or approaches.

These strategies emphasize what it takes to adapt and remain a rock star as the business pivots. The key is in accepting and embracing the new metrics of success, understanding how your skills can uniquely contribute to the future, and role-modeling this adaptable behavior. Above all, rock star performers embrace the idea that they control their destiny and that the decisions they make today will create their success tomorrow.

Jennifer J. Fondrevay is the founder of Day1 Ready, an M&A consultancy focused on providing human capital strategies that retain deal value. Her book, Now What? A Survivor’s Guide for Thriving through Mergers & Acquisitions, guides executives and middle managers through the challenges of business transformation to retain talent and minimize loss in productivity.

Amy Franko is the founder of Amy Franko Associates, a sales consultancy focused on helping midmarket organizations grow sales results through strategy and skill development. Her book, The Modern Seller, guides sales professionals and leaders in building next-generation sales capabilities. She is recognized by LinkedIn as a Top Sales Voice.