To be a ‘lame duck’ is to lose power. Or so the thinking goes. Popularized in politics, the term lame duck refers to an elected official still in office who will soon be succeeded. The official typically experiences diminished influence and authority as they await their successor’s assumption of power. President Joe Biden’s extended lame duck period since withdrawing from the presidential election, is a perfect example of a leader appearing less effective at the end of his term as the public focuses on the newcomer.

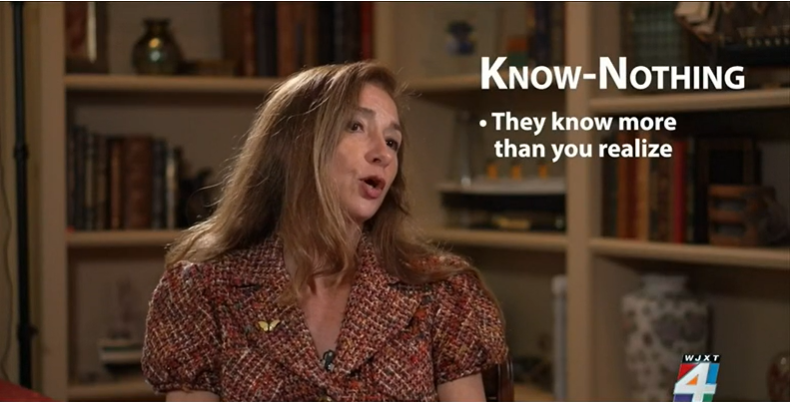

Click here to read the full article in Forbes, where Jennifer talks about how ineffective leadership during a transition can undermine M&A deal success. She outlines the three leadership behaviors that can hinder post-deal results, and three strategies for being an effective leader during the transition.